What is a Gearing Ratio? Definition, Formula and Calculation IG International

Conversely, a company that never borrows might be missing out on an opportunity to grow its business by not taking advantage of a cheap form of financing, especially when interest rates are low. Return on equity, or roe, is a measurement of financial performance arrived at by dividing net income by shareholder equity. Although there is no absolute guide to what an ideal gearing ratio should be, a general rule of thumb suggests minimum 25% and maximum 50% leverage ratio as a safe benchmark.

Do you already work with a financial advisor?

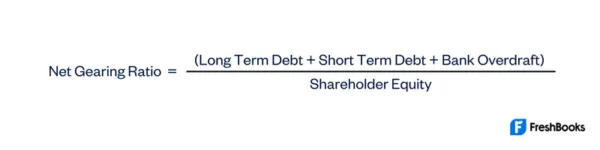

The key four ratios include Time Interest Earned, Equity Ratio, Debt Ratio, and Debt-toEquity Ratio. Where D is the total debt i.e. the sum of interest-bearing long-term and short-term debt such as bonds, bank loans, etc. It also includes other interest-bearing liabilities such as pension obligations, lease liabilities, etc.

Calculation Examples of Gearing Ratio Formula

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Equity holders (i.e., ordinary shareholders) are paid a dividend that varies each year with the volume of profits made. For example, agricultural companies often need to borrow money on short-term basis as the industry is affected by seasonal demand. Therefore, it gives a beneficial insight into the company’s leverage position.

Good/Bad: What Is a Good Leverage & Gearing Ratio?

Hence, a highly geared company must earn enough profit to first cover its payments to holders of debt before anything is available for distribution to the holders of equity (e.g., dividends). Hence, a company that never uses leverage is likely missing out on an opportunity to grow its business by taking advantage of debt financing. This is especially true when interest rates are low and the business enjoys healthy and predictable cash flows. Similarly, if the company is highly geared and wants to reduce the gearing, the company can issue more shares and pay back the debt.

Understanding Gearing Ratio: Definition, Formula & Examples

The most common approach for estimating the gearing ratio is utilizing the debt-to-equity ratio, i.e., a company’s debt divided by its shareholders’ equity. In addition, it is calculated by subtracting a company’s total liabilities from its total assets. Gearing refers to the utilization of debt financing to amplify exposure to assets and potential returns. Companies deploy gearing to leverage equity and expand operations, with the gearing ratio quantifying the degree to which financial leverage is employed in the capital structure. First, they can generate more income to pay off debts, thereby reducing the debt-to-equity ratio. Second, they can issue more equity to dilute the proportion of debt in the capital structure.

Gearing Ratio vs Other Financial Metrics

- Equity holders (i.e., ordinary shareholders) are paid a dividend that varies each year with the volume of profits made.

- When an organisation has more debt, there is a higher risk of financial troubles and even bankruptcy.

- Effectively managing gearing ratios is essential for maintaining a balanced financial structure and ensuring long-term sustainability.

- A company with too much debt might be at risk of default or bankruptcy especially if the loans have variable interest rates and there’s a sudden jump in rates.

- A gearing ratio is a measurement of a company’s financial leverage, or the amount of business funding that comes from borrowed methods (lenders) versus company owners (shareholders).

A company whose cwfr is in excess of 60% of the total capital employed is said to be highly geared. A company’s gearing ratio is used by a wide range of stakeholders, including investors, lenders, and analysts. Lenders use it to assess a company’s ability to repay its debts, while analysts use it to compare companies within the same industry or sector. Using a company’s gearing ratio to gauge its financial structure does have its limitations. This is because the gearing ratio could reflect a risky financial structure, but not necessarily a poor financial state.

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Ask a question about your financial situation providing as much detail as possible. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Investors often view companies with lower gearing as more stable and less risky, which can lead to a higher valuation and lower cost of equity. Conversely, companies with high gearing may be seen as riskier investments, potentially leading to a lower stock price and higher cost of capital. This perception can impact a company’s ability to raise funds through equity markets, further affecting its financial performance. While gearing ratios are valuable for evaluating a company’s financial health, it has limitations.

This ratio is an indispensable tool investors, lenders, and companies use to assess financial health. Lenders may consider a company’s retail accounting basics when deciding whether to provide it with credit. A gearing ratio is a financial ratio that compares some form of capital or owner equity to funds borrowed by the company.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

コメントを残す